wa sales tax registration lookup

If they have professional license violations. The URL Interface provides a direct access to the Washington Department of Revenues address based rate lookup technology platform.

Sales Tax Registration in Washington.

. You can search by. Because the state line is down the middle of the river the vessel will cross into Washington. Use this app to find current Washington sales tax rates quickly and easily from anywhere using GPS at your current location or by searching for an.

Skip to main content For full. Look up a tax rate on the go. Washington WA Sales Tax Rate.

To calculate sales and use tax only. Of Revenues tax and business licensing services. Instructions for using the Business Lookup are on the My DOR help page.

With local taxes the total sales tax rate is between 7000 and 10500. The company conducted more than 200. Ad Fill out one form choose your states let Avalara take care of sales tax registration.

If weve issued a professional license to a person or business. File pay taxes. To calculate sales and use tax only.

Ad Fill out one form choose your states let Avalara take care of sales tax registration. If the person who gave. If you have questions about the requirements for franchising in Washington or to check to see whether a particular franchise has filed with the Division of Securities please contact Trang.

When their license expires. Taxpayers must display the registration certificate in a conspicuous location at the place of business. Register your vehicle or boat in Washington update or replace your title get or renew a disabled parking permit and learn about prorate and fuel tax licenses.

When using the vendor look up enter only last name or. Washington has recent rate changes Thu Jul 01. Report no business activity.

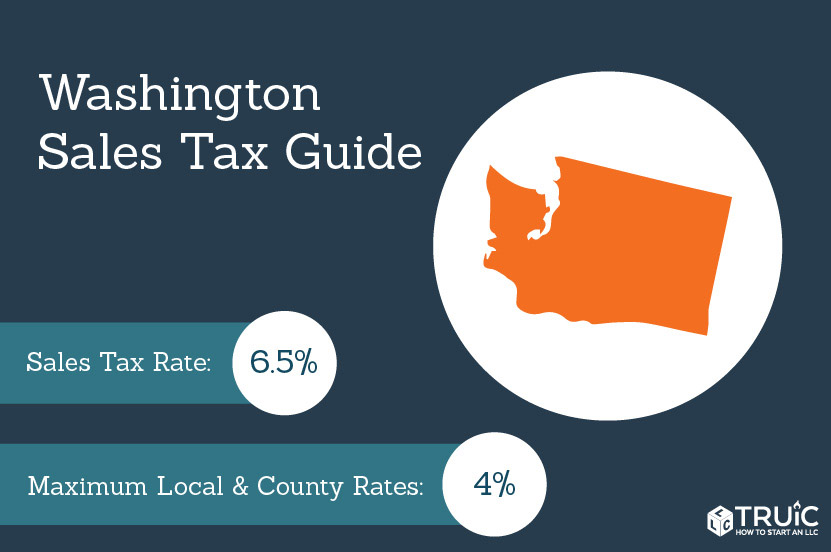

Assessor Kittitas County Assessor 205 West 5th Ave Suite 101. Renewal and registration fee information. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 percent and 39 percent.

There is a state sales tax as well as various local rates. Statewide vendor number lookup. How to register for a sales tax registration number in Washington.

Tax registration is the second step in starting a business in DC. Simplify the sales tax registration process with help from Avalara. ZIP--ZIP code is required but the 4 is.

Please press Enter to open the search input box and press tab to start writing to search somthing. Regional Transit Authority RTA tax. RCW 8232030 WAC 458-20-101.

Maximum rate for local municipalities. Apply for a tax refund. Youll find rates for sales and use tax motor vehicle taxes and lodging tax.

May 17 2022 800 PM to May 18 2022 600 AM PT My DOR including. Fees taxes and donations. A sales tax registration number can be obtained by registering through the Department of Revenues.

WA Sales Tax Rate Lookup URL Interface. You will need Business License registration or sales and use tax registration to run your business in Washington state. Use of the vessels is presumed to be on the Columbia River.

Filing frequencies due dates. Use this search tool to look up sales tax rates for any location in Washington. Vehicles received as gifts.

The state sales tax rate in Washington is 6500. To close it press Escape key. Simplify the sales tax registration process with help from Avalara.

Lookup other tax rates. File or amend my return. If you can provide proof that the person who gave you the vehicle or vessel paid sales or use tax on the vehicle or vessel no use tax is due.

Search for Kittitas County property tax sales and assessment records by address parcel number or legal description. Secure access to Washington State Dept. The companys gross sales exceed 100000 or.

Find the TCA tax code area for a specified location. Wa Sales Tax Registration Lookup. RCW 8232030 WAC 458-20-101.

If their license is active. Search by address zip plus four or use the map to find the rate for a specific location. The Statewide Vendor database online search is intended for status inquiries of active vendors.

Look up a tax rate on the go. For example under the South Dakota law a company must collect sales tax for online retail sales if. Purchase and use of vessels by.

Find Sales tax rates for any location within the state of Washington. Washington sales tax rates vary by location. Download our Tax Rate Lookup App to find.

This tool allows you to look up and verify reseller permits by individual business.

How Do State And Local Sales Taxes Work Tax Policy Center

6 Differences Between Vat And Us Sales Tax

U S Sales Tax Explained For Both U S And Non U S Sellers Sellics

Please Check Out All The Photos And Contact Me With Any Questions Free Shipping To The Usa Vintage Stamps Postage Postage Stamp Collecting Postage Stamps Usa

Setting Up Sales Tax In Quickbooks Online

How Do State And Local Sales Taxes Work Tax Policy Center

Caja Registradora Olivetti Ecr 8220s Teclado Plano Top Baby Toys Happy Birthday Gifts Cash Register

States With Highest And Lowest Sales Tax Rates

Connecticut Craft Fair Connection A Free Event Calendar And Resource For The Artists And Crafters Of Connecticut Craft Fairs Crafts Craft Sale

How To Register For A Sales Tax Permit Taxjar

Sales Tax By State Is Saas Taxable Taxjar

Changes To U S Online Sales Tax In 2019 Wix Com

Washington Sales Tax Small Business Guide Truic

Sales Tax On Webflow Subscriptions Webflow University

What Is My Sales Tax Id Number Craftybase

How To Collect And Pay Sales Tax In Quickbooks Desktop Youtube